Reach for the skies: How easyJet won the battle for branding at 35,000ft

In the summer of 2014, budget airline Ryanair announced that its net profit for the first quarter of the year had risen to €197m, a staggering 152% increase year-on-year. It followed a huge shift in the company’s brand personality, something it changed because ‘that’s what our customers want us to do’, according to chief Michael O'Leary.

He was right. The announcement followed several poor performances in customer satisfaction polls, achieving the top spot in the Which? 2013 list of the worst brands for customer service. Despite the recent change in its personality, the airline is still playing catch-up after one of the greatest examples of brand reinvention in recent times – that of rival carrier, easyJet.

In November 2013, even O’Leary himself admitted that easyJet had ‘wiped the floor’ with Ryanair, following an intensive 12 month brand repositioning, including key changes to customer service such as allocated seating and an improved digital experience.

The battle begins

The fight for customers in the skies of the UK and Europe has often been a bitter one, and the last decade has been no exception. The no-frills era brought about some of the fiercest financial, communication and brand battles ever known. Two of the nation's earliest front runners, Buzz, from KLM and British Airways' Go fell fast. They were bought out by Ryanair and easyJet after just four and seven years respectively, a shock, given the heritage of their parent brands.

The demise of Go in particular came weeks after Ryanair chairman Michael O'Leary said that the winter of 2004 would result in a "bloodbath" from which only two or three low-cost airlines would survive. In this fledgling, disruptive market, BA's foundations and heritage meant nothing, and the sector quickly descended into a relentless war on cost.

A battle fought on price

Both Go and Buzz, with their nippy names and simple but considered approach to branding, were praised within the industry. Go in particular was considered a smart extension of the British Airways business, allowing it to reach a much greater audience. However, it was the cheekier, and crucially, cheaper services of Ryanair and easyJet that caught the nation's attention.

It was a new market with new rules. Costs were so low that flying no longer became part of the holiday experience, it became a means to an end. As everyday as getting the bus to work. Ryanair and easyJet capitalised on this, fighting head on through the nation's newspapers, driving down price until flights were as little as 99p, excluding tax.

A battle fought on reputation

As prices took a nosedive, the quality of customer service quickly followed suit and by 2011, the reputation of both businesses was lower than ever. easyJet realised the need to change first. They hired ex-Guardian Media Group head Carolyn McCall – a woman who shrewdly asked the Operations Director what problems there were with the business – before she’d even interviewed for the job. He told McCall that the business had lost the faith of its customers and its staff, after sacrificing quality over cost for too many years. He was right. They were failing to land more than 50% of flights on time at Gatwick, according to the Sunday Times.

McCall knew something had to change, and with the help of marketing director Peter Duffy, the business embarked on its first repositioning in the 17 year history of the business. The strategic brand development programme, and communications campaign that followed, was aimed at reconnecting passengers with the joy of flying, holidaying and even business travel.

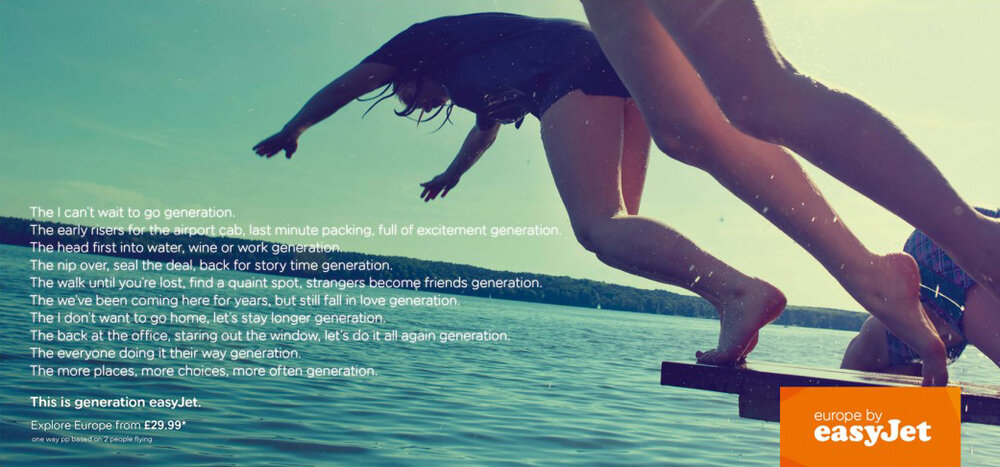

Featuring headlines such as 'This is generation easyJet' and 'Europe by easyJet', the £50m repositioning focussed on the final destination, and the subsequent emotional experience for customers.

Alongside a new direction in tonality, the brand shifted typographically too. Though its no-frills typeface Cooper Black remained in the logo, it was shrewdly dropped from body copy, ridding the business of a design element so symbolic of 'cheap', that will scarcely be used by another brand again. In its place, a refreshed sans-serif typeface, coupled with an angular, orange supergraphic brought new warmth to the business.

VCCP, the ad agency behind the campaign, reaffirmed this rationale. It suggested that easyJet’s "low prices and expanding network of destinations heralded the democratisation of air travel which has meant everyone is able to do more of the things they love – whether it be exploring new holiday experiences, new business opportunities or visiting friends and family".

VCCP introduced a new tone to help revitalise the brand:

But how successful was the strategy? Incredibly so.

In the six months that followed, revenue-per-seat rose from £45.11 to £50.47 and passenger numbers were up as much as 3.7million. Its predicted Winter losses (not unusual for an airline) were cut from an estimated £153m to £112m and in October 2012, it announced record profits, rising 28% year-on-year. It was money well spent.

Becoming a marketing leader

Since the re-launch, McCall and Duffy highlighted two powerful brand measures to Marketing Magazine. McCall stated “We’ll never move away from price – it’s the cornerstone of what we do. But now we communicate destination and service”. She added that consumers see “A lot of blue water between us and Ryanair, and very little between us and British Airways”. The shift in brand reputation was clear.

The success wasn't down to above-the-line press ads and TV spots alone. E-consultancy reported that even easyJet's email marketing became the third best performing of any brand in the UK – with Ryanair trailing far behind.

As Ryanair plays catch up in terms of brand and communications improvements, the business still outperforms easyJet in terms of profit and passenger numbers – so does brand matter?

We think so. The perceived shift between the two businesses will engender greater loyalty and repeat brand interaction for easyJet. The fruits of this labour are already being felt and this will only increase. These results may indeed follow for Ryanair too, but as O'Leary plays catch up, McCall may be one step ahead in brand innovation.

The one thing we can be certain of, is that the era of “pile it high and sell it cheap” is over, and as O’Leary himself put it, the industry had to “change tactic”. Their marketing officer, Kenny Jacobs, compared their new brand approach to that of low-cost brands like Aldi, Ikea and H&M, who maintain high perception levels alongside low cost. He might be right, but we’d add easyJet to that list too.